Get This Report on Home Loan Calculator

Table of ContentsThe smart Trick of Home Loan Calculator That Nobody is DiscussingThe Best Guide To Home Loan LenderExcitement About Clark Finance Group Refinance Home LoanThe 8-Minute Rule for Clark Finance Group Refinance Home LoanWhat Does Clark Finance Group Mortgage Broker Do?

Because of that, a individual line of credit report or bank card could be an extra useful financing option, as you can borrow on a rolling basis. 15. Entertainment automobile and watercraft financings Whether you're looking for a mobile home or a motor boat, you might need aid funding it. Personal loan lending institutions typically enable you to borrow for this function.You might borrow as required, however, up to your credit history restriction. It's constantly a great suggestion to zero your credit score card equilibrium each month so that you do not pay the double-digit interest rates linked with Visa, American Express as well as other creditors.

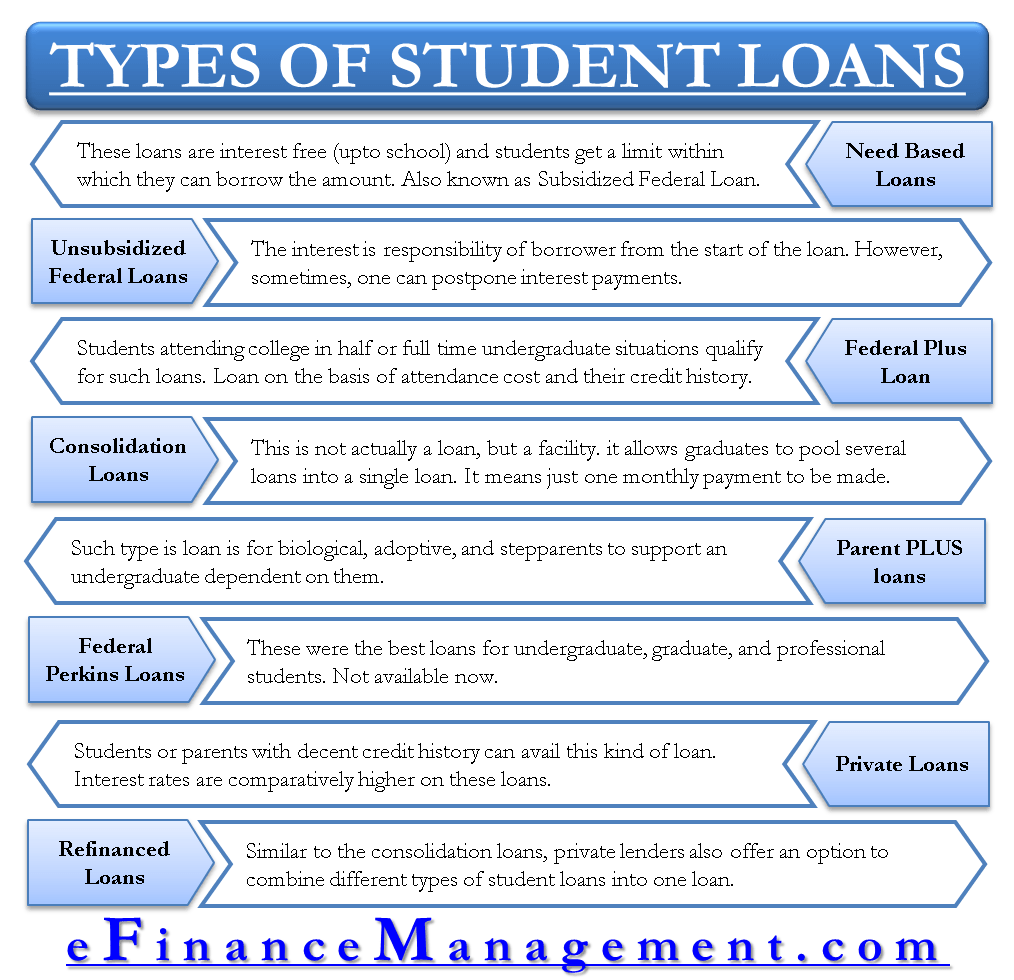

Whether you're looking to finance a "need" or a "desire," there are lots of various kinds of car loans. And although it might be noticeable to you what kind of car loan to borrow, you might not be 100% sure concerning the certain loan terms.

The Of Home Loan Calculator

Unprotected vs. guaranteed lendings When it comes to the various sort of fundings, they all fall right into a couple of groups: unsafe and also safeguarded. An unsecured lending does not require security in order for you to be qualified. A safe financing does need collateral, such as your vehicle or an interest-bearing account, and its worth could affect just how much you're qualified to borrow. Clark Finance Group Mortgage broker.

Most types of car loans come with fixed passion rates, however the price you obtain for either will be based on your credit scores rating.

The Main Principles Of Clark Finance Group Mortgage Broker

Repaired rate of interest permit you to know simply just how much the financing will cost you in its totality and also permit you to budget plan appropriately. Variable rates of interest lendings might conserve you money if rates of interest decrease, however if they increase, they might wind up costing you much more. While they do have ceilings to protect borrowers from expensive dives in the marketplace, those ceilings are usually established fairly high.

Conventional Fixed Price Mortgages A home loan in which the rate of interest continues to be the very same throughout the entire life of the financing is a standard fixed price home mortgage. These loans are one of the most preferred ones, standing for over 75% of all house finances. They generally come in regards to 30, 15, or ten years, with the 30-year option being the most preferred.

The biggest benefit of having a set price is that the home owner understands exactly when the rate of interest and also primary settlements will be for the length of the finance. This enables the property owner to budget plan less complicated since they know that the rate of interest will never alter for the period of the financing.

Home Loan Lender Can Be Fun For Everyone

The rate that is set in the start is the price that will certainly be charged for the entire life of the note. The property owner can budget since the monthly settlements stay the exact same throughout the whole size of the loan. When prices are high as well as the home owner obtains a set price home mortgage, the home owner is Source later on able to refinance when the prices go down.

Some financial institutions desiring to maintain a good client account may wave closing prices. If a customer purchases when rates are reduced they maintain that rate secured also if the broader interest rate setting rises. House buyers pay a premium for locking in certainty, as the passion prices of fixed rate financings are usually higher than on flexible price residence fundings.

What Does Clark Finance Group Do?

The majority of down payments are around 10% or greater. The FHA program supplies down repayments for as low as 3.

Customers can buy a residence in any kind of community located in the United States, the District of Columbia, or any type of region the USA holds. You can buy a single household house, two unit houses, three and 4 device houses, condominiums, mobile homes, and manufactured homes. Every home-buyer does not have a social security number.